Some Known Details About Transaction Advisory Services

Table of ContentsTransaction Advisory Services Things To Know Before You Get ThisExcitement About Transaction Advisory ServicesUnknown Facts About Transaction Advisory ServicesThe Ultimate Guide To Transaction Advisory ServicesA Biased View of Transaction Advisory Services

This step makes sure the business looks its finest to potential purchasers. Obtaining the company's worth right is vital for an effective sale.Transaction advisors step in to help by getting all the needed info organized, responding to questions from customers, and setting up brows through to the service's area. Transaction advisors utilize their experience to help service owners manage hard settlements, meet buyer expectations, and structure deals that match the owner's objectives.

Fulfilling legal guidelines is crucial in any kind of company sale. They aid company proprietors in planning for their following steps, whether it's retirement, beginning a new endeavor, or managing their newfound riches.

Deal advisors bring a riches of experience and expertise, making certain that every aspect of the sale is taken care of expertly. Via critical preparation, evaluation, and negotiation, TAS assists company owner attain the highest possible price. By ensuring legal and regulative conformity and managing due diligence together with various other deal staff member, purchase advisors reduce possible threats and liabilities.

Transaction Advisory Services Things To Know Before You Get This

By comparison, Huge 4 TS groups: Work on (e.g., when a possible purchaser is performing due diligence, or when a deal is shutting and the purchaser needs to incorporate the business and re-value the vendor's Annual report). Are with charges that are not linked to the offer shutting effectively. Gain charges per involvement somewhere in the, which is much less than what investment banks earn also on "tiny bargains" (but the collection chance is likewise a lot greater).

The interview questions are very similar to investment banking meeting questions, however they'll concentrate much more on bookkeeping and appraisal and much less on topics like LBO modeling. Anticipate inquiries regarding what the Modification in Working Capital means, EBIT vs. EBITDA vs. Take-home pay, and "accountant only" subjects like trial balances and just how to stroll with events making use of debits and credit histories instead of monetary statement modifications.

9 Easy Facts About Transaction Advisory Services Shown

Professionals in the TS/ FDD teams may also interview monitoring about every little thing over, and they'll create a thorough record with their searchings for at the end of the procedure.

, and the general form looks like this: The entry-level duty, where you do a great deal of data and financial analysis (2 years for a promotion from below). The following level up; similar work, however you get the even more intriguing bits (3 years for a promotion).

Specifically, it's hard to obtain promoted beyond the Supervisor degree since couple of people leave the work at that stage, and you require to begin showing proof of your capacity to generate earnings to breakthrough. Let's begin with the hours and way of life because those are easier to define:. There are occasional late evenings and weekend break work, however nothing like the agitated nature of investment banking.

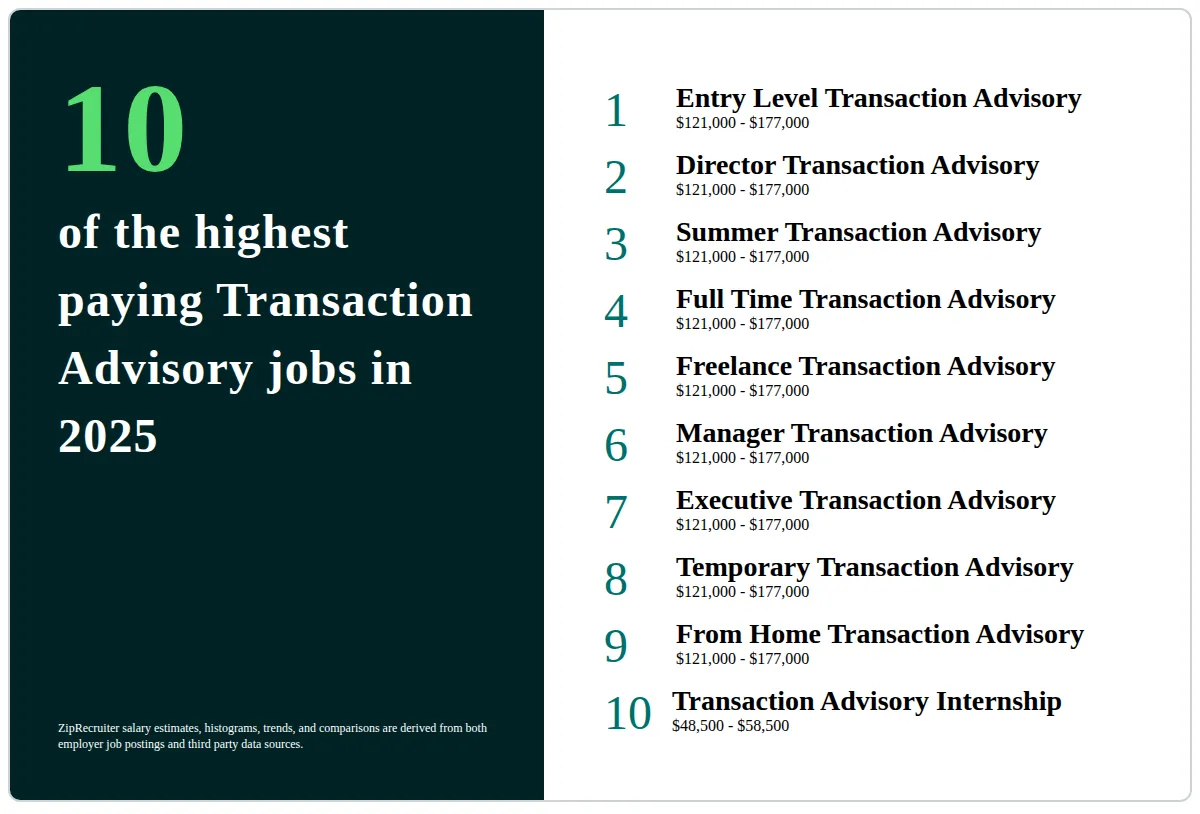

There are cost-of-living modifications, so anticipate reduced settlement if you're in a more affordable area outside major monetary (Transaction Advisory Services). For all positions except Companion, the base wage comprises the mass of the overall settlement; the year-end incentive could be a max of 30% of your base pay. Commonly, the very best means to enhance your incomes is to change to a various firm and discuss for a greater wage and bonus

The Main Principles Of Transaction Advisory Services

You can obtain into company advancement, but financial investment financial gets harder at this stage due to the fact that you'll be over-qualified for Analyst duties. Corporate money is still a choice. At this phase, you must simply stay and make a run for a Partner-level duty. If you wish to leave, possibly transfer to a customer and do their appraisals and due persistance in-house.

The main issue is that because: You usually need to sign up with another Huge 4 team, such as audit, and job there for a few years and afterwards relocate into TS, work there for a couple of years and afterwards move into IB. And there's still no assurance of winning this you can check here IB duty because it depends upon your area, customers, and the hiring market at the time.

Longer-term, there is likewise some threat of and due to the fact that examining a firm's historic monetary info is not specifically rocket science. Yes, people will constantly require to be involved, yet with even more advanced innovation, lower head counts could possibly support customer involvements. That said, the Transaction Solutions group defeats audit in regards to pay, job, and leave possibilities.

If you liked this article, you may be thinking about reading.

Some Known Details About Transaction Advisory Services

Create advanced economic structures that help in figuring out the actual market price of a company. Provide consultatory operate in relation to service evaluation to help in negotiating and rates frameworks. Discuss one of the most ideal form of the offer and the sort of consideration to utilize (cash money, supply, earn out, and others).

Establish activity strategies for threat and exposure that have been determined. Do assimilation planning to identify the process, system, and organizational modifications that might be called for after the bargain. Make numerical estimates of integration this post expenses and benefits to examine the financial reasoning of assimilation. Establish standards for incorporating divisions, technologies, and business processes.

Recognize potential reductions by lowering DPO, DIO, and DSO. Evaluate the prospective consumer base, industry verticals, and sales cycle. Think about the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence uses essential insights into the functioning of click site the company to be gotten concerning risk evaluation and value production. Recognize short-term modifications to financial resources, financial institutions, and systems.